2022 tax brackets

22 for incomes over 41775 83550 for married couples filing jointly. To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax brackets 2021 tax brackets Full 2022 tax rates schedules and contribution limits PDF Log in to get your tax forms IRS website Free IRS publications.

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

22 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

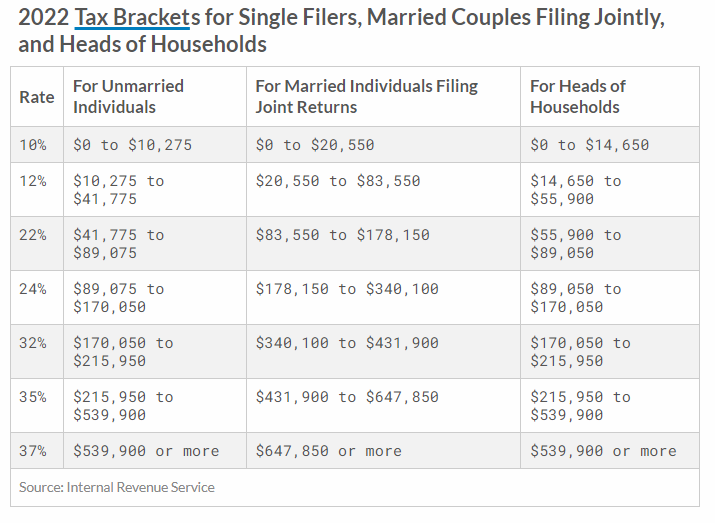

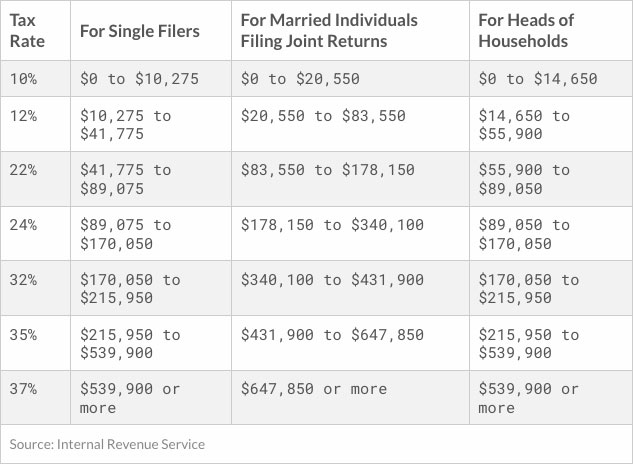

. 32 for incomes over 170050 340100 for married couples filing jointly. There are seven federal income tax rates in 2022. 10 percent 12 percent 22 percent 24.

35 for incomes over 215950 431900 for married couples filing jointly. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. Taxable income between 41775 to 89075.

Taxable income between 89075 to 170050. Whether you are single a head of household married etc. The next chunk up to 41775 x 12 12.

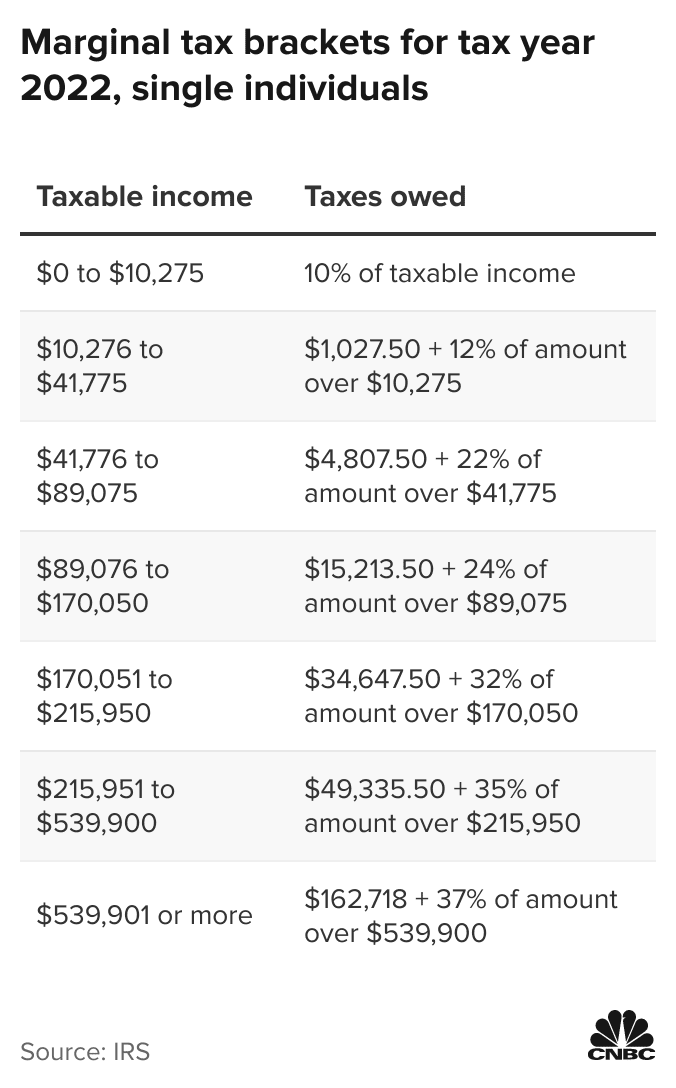

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140 24 tax on the. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for married couples filing jointly. Taxable income between 10275 to 41775.

24 for incomes over 89075 178150 for married couples filing jointly. Break the taxable income into tax brackets the first 10275 x 1 10. Taxable income up to 10275.

10 12 22 24 32 35 and 37 depending on the tax bracket. And the remaining 15000 x 22 22 to produce taxes per bracket of 1025 3780 3300 total tax bill of 8105. 10 12 22 24 32 35 and.

For a final figure take your gross income before adjustments. The federal income tax rates for 2022 did not change from 2021. Below you will find the 2022 tax rates and income brackets.

There are seven federal tax brackets for the 2021 tax year.

Twitter এ Tax Foundation 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw ট ইট র

Tax Changes For 2022 Including Tax Brackets Acorns

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

70 Qoqppyaedvm

Inflation Pushes Income Tax Brackets Higher For 2022

Tax Bracket Calculator What S My Federal Tax Rate 2022

2022 Income Tax Brackets And The New Ideal Income

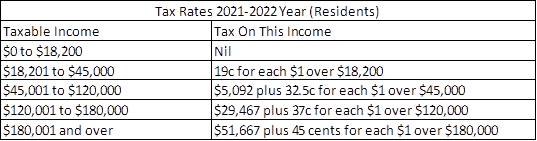

Everything You Need To Know About Tax In Australia Down Under Centre

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

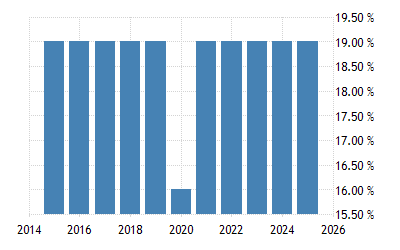

Germany Sales Tax Rate Vat 2022 Data 2023 Forecast 2000 2021 Historical

2022 Tax Brackets Internal Revenue Code Simplified

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Inflation Pushes Income Tax Brackets Higher For 2022

What Is The Difference Between The Statutory And Effective Tax Rate

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest